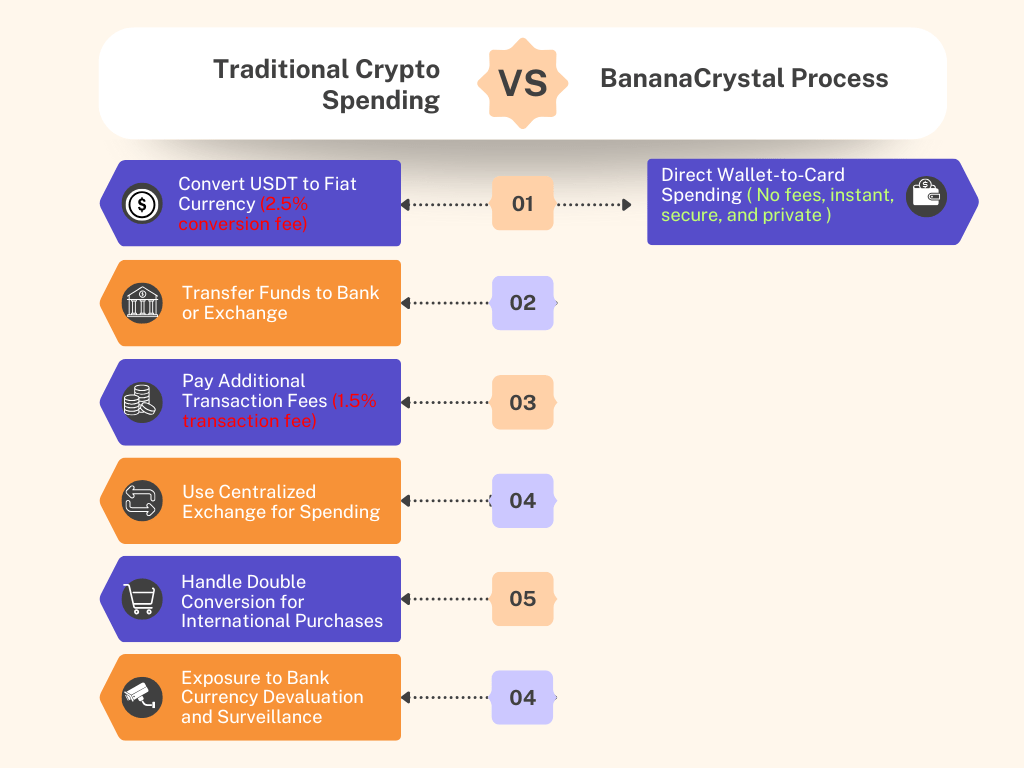

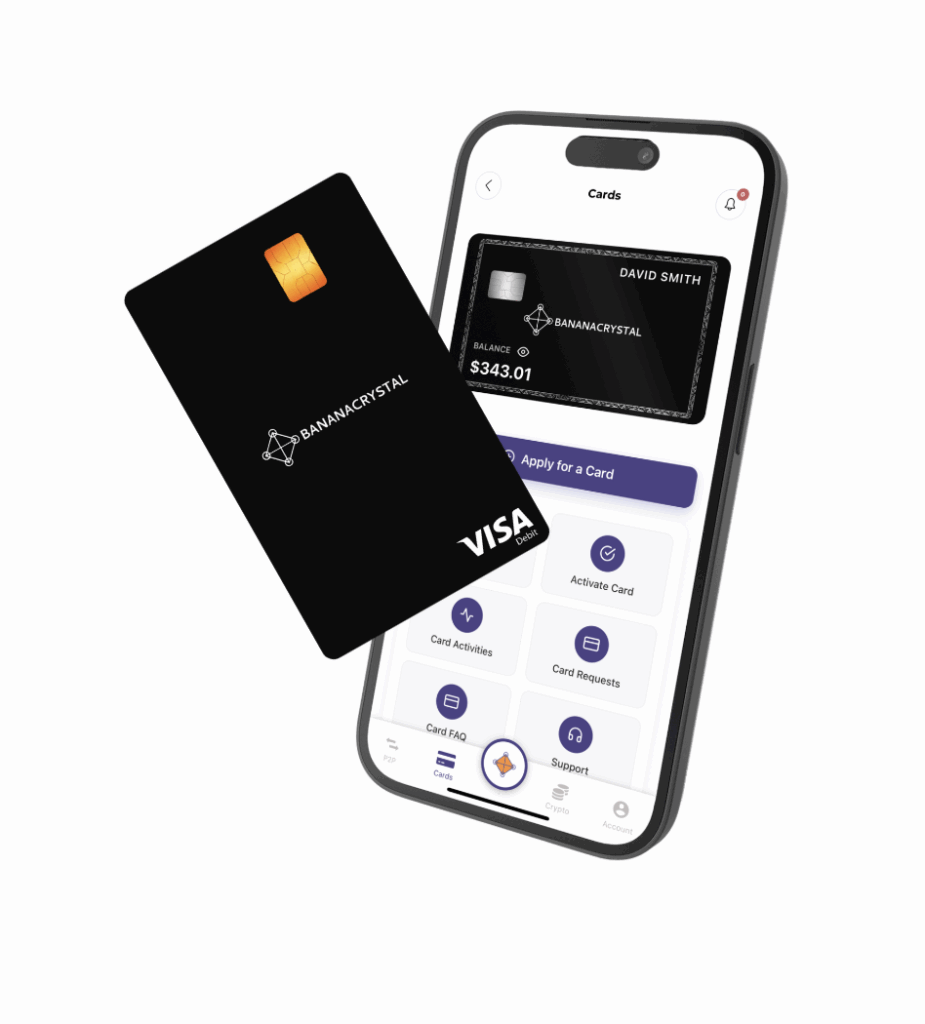

Introducing the BananaCrystal USD Debit Card:

Your Direct Bridge from Crypto to Global Spending

BananaCrystal gives you a VISA-powered USD debit card connected directly to your USDT wallet through a private offshore bank,

eliminating the gap between your crypto assets and everyday spending.

Freedom

Spend your USDT directly without conversion delays or exchange fees. Your crypto becomes instantly usable currency anywhere.

Privacy

Your financial information stays protected through offshore banking protocols and advanced encryption. No reporting to traditional banking systems.

Global Acceptance

Use your card at 80+ million merchants and ATMs worldwide. From luxury hotels in Dubai to street markets in Bangkok, your purchasing power follows you.

Simplicity

Load instantly from your wallet with our intuitive mobile app. No complicated exchange processes or lengthy transfer times.

Private Offshore Bank Account

Animated illustration showing USDT flowing directly from wallet to card to purchase with smooth transition and no intermediary steps

Security

Military-grade encryption with real-time transaction alerts and one-tap freeze capability. Your assets remain protected 24/7.